Sis, wag ka nang ma-stress!

Take Control of Your Finances with These Budgeting Templates

Sis, wag ka nang ma-stress!

Take Control of Your Finances with These Budget Templates

Pansin mo din ba? Pataas nang pataas ang presyo ng mga bilihin, pero ang income ganun pa din. Ka-stress diba?

Juggling expenses in this crazy world can feel impossible, but hey, you are not alone!

We've all been there...

At hindi mo kailangan ng complicated na budgeting apps. Sometimes, the simplest solutions are the best.

These printable budget templates are your secret weapon to finally conquer your finances.

Why pen and paper?

It might sound simple, but there's a reason these templates are printable!

Studies show that writing things down strengthens the connection between your thoughts and goals.

When you physically record your income and expenses, it forces you to be mindful.

It's more than just numbers on a screen – it's your financial future you're planning!

Plus, there's something incredibly satisfying about seeing your progress on paper – it's a tangible reminder of your hard work.

This is for you if...

You're tired of feeling like you're constantly one step away from broke.

Remember that time you had to choose between groceries and that birthday gift for your niece or nephew? Ugh, the struggle is real!

You dream of achieving financial goals but don't know where to start.

Maybe it's finally fixing up your house for your parents, or that dream vacation to Boracay with your high school friends, or that inverter aircon to keep you cool this summer!

You want a simple and effective way to track your spending.

Let's face it, staring at a budgeting app can be confusing and how you wish you can make your own app because that one doesn't resonate with you.

You crave the satisfaction of being in control of your money.

Imagine the feeling of knowing exactly where your hard-earned cash is going! Ah, it's liberating!

This is NOT for you if...

You enjoy the mystery of where your money goes each month.

Seriously, is it better to live in blissful ignorance, or take charge and create a brighter future?

You prefer living paycheck to paycheck with constant anxiety.

Sis, that stress is already affecting your health (and maybe your relationships too!)

You believe budgeting is a chore and not a path to financial freedom.

Trust me, once you see your progress, it becomes super empowering! Budgeting isn't punishment, it's like giving your money a purpose!

You're not ready to be the boss of your finances!

This might sound scary, but these templates make it easy and fun. Imagine the feeling of being in control and finally saying "yes" to the things you want without guilt!

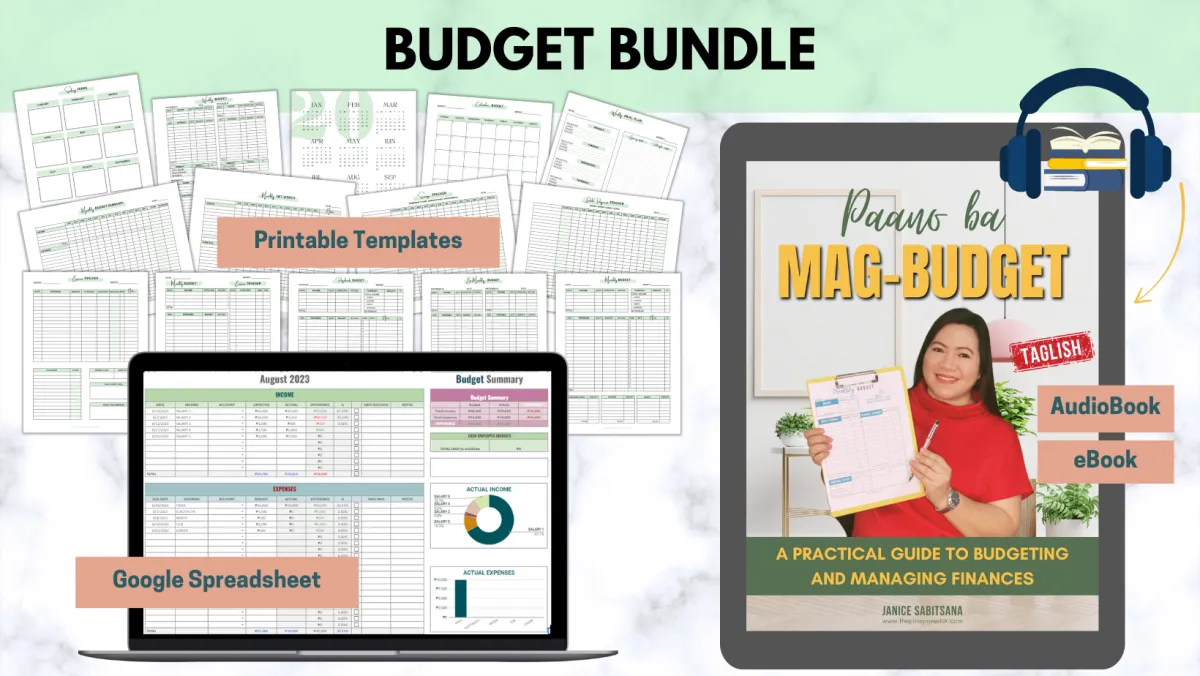

INTRODUCING PINAY INVESTOR'S

Say Goodbye to Confusing Apps! Hello to Simple Budgeting

Forget those complicated apps that make budgeting feel like another chore. These printable templates are designed with Pinays like you in mind.

I understand the unique challenges we face – unexpected family gatherings, the occasional birthday surprise, and let's be honest, the ever-present temptation of a delicious coffee or milk tea, samahan pa ng cake o cookie.

These templates have categories that reflect your real life, so you can finally see exactly where your money goes.

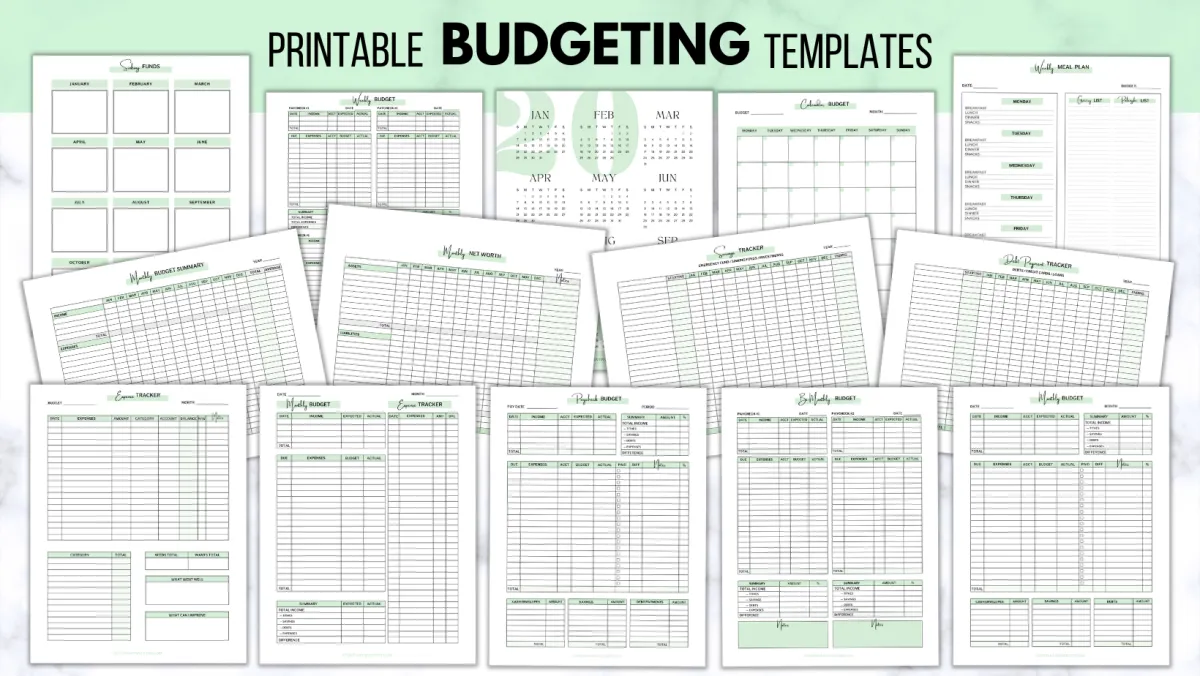

what's included

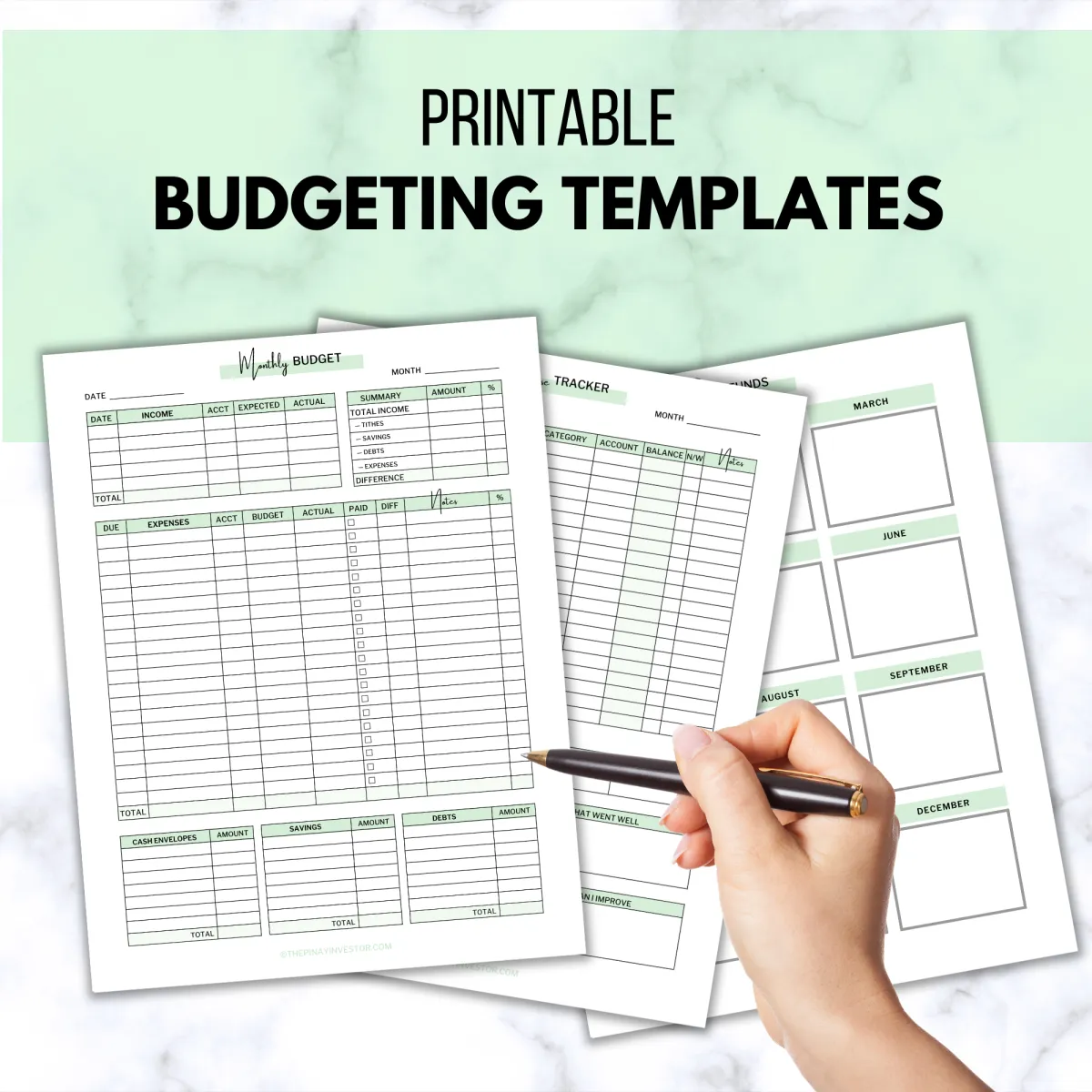

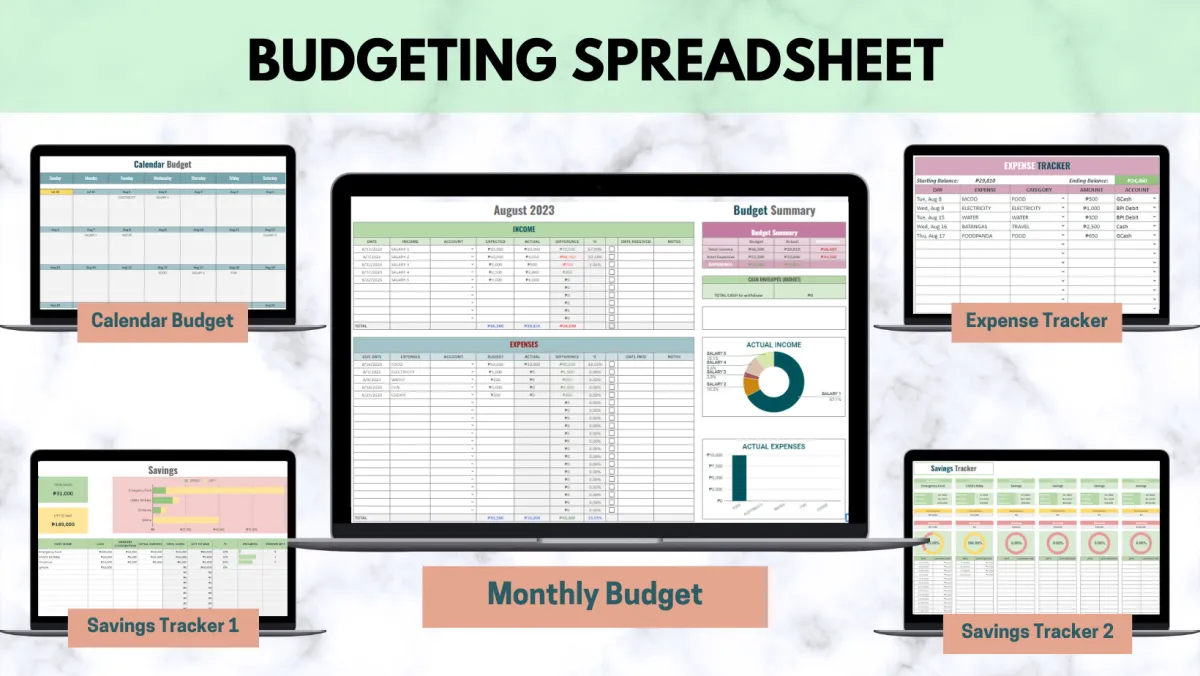

Monthly Budget: This is where you'll plan your income and expenses for the month, helping you to stay within your financial limits.

Expense Tracker: A detailed tool to record and monitor your daily spending, giving you insights into your spending habits.

Monthly Budget & Expenses Tracker: A combination of the first two templates, it allows you to plan and track your budget and expenses simultaneously.

Paycheck Budget: Ideal for those who want to budget per paycheck. It helps you allocate your income to your bills, expenses, and savings goals.

Bi-Monthly Budget: Designed for individuals who receive their income twice a month, making it easier to manage your budget based on when you receive your pay.

Weekly Budget: Perfect for those who prefer to manage their money on a week-by-week basis.

Calendar Budget: A visual way to see your income, expenses, and savings goals on a daily basis throughout the month.

Weekly Meal Plan: Helps you plan your meals, potentially saving you money on groceries and eating out.

Monthly Budget Summary: At the end of each month, use this template to review your income, expenses, and savings and see how well you adhered to your budget.

Monthly Net Worth Tracker: A tool to monitor your assets and liabilities, helping you understand your overall financial health.

Savings Tracker: Set your savings goals and monitor your progress towards reaching them.

Debt Payment Tracker: Keep track of your debt payments to ensure you're staying on top of your debts.

Financial Goals Tracker: Identify and track your short-term and long-term financial goals.

Sinking Funds Calendar: A tool to help you save for specific future expenses (like vacations or car repairs) over time.

2024 Calendar: A full calendar for the year 2024 to help you plan your financial year in advance.

Habit Tracker: Encourages you to develop good financial habits by tracking your daily progress.

New templates that I will to this bundle overtime!

testimonials

Cristy

Sobrang helpful ng budgeting templates at spreadsheet. Ang dali lang pala mag-budget, mahirap lang sa una pero sanayan lang. Disiplina lang talaga para makapag-save at invest.

Mary Jane

Relate na relate ako dito ang hirap mag budget. Totally agree with you when you say "eliminate debts" as much as possible. Toxic mindset yan. Salamat po sa iyong mga advise. It really helps!

watch my budgeting videos

WHO IS PINAY INVESTOR

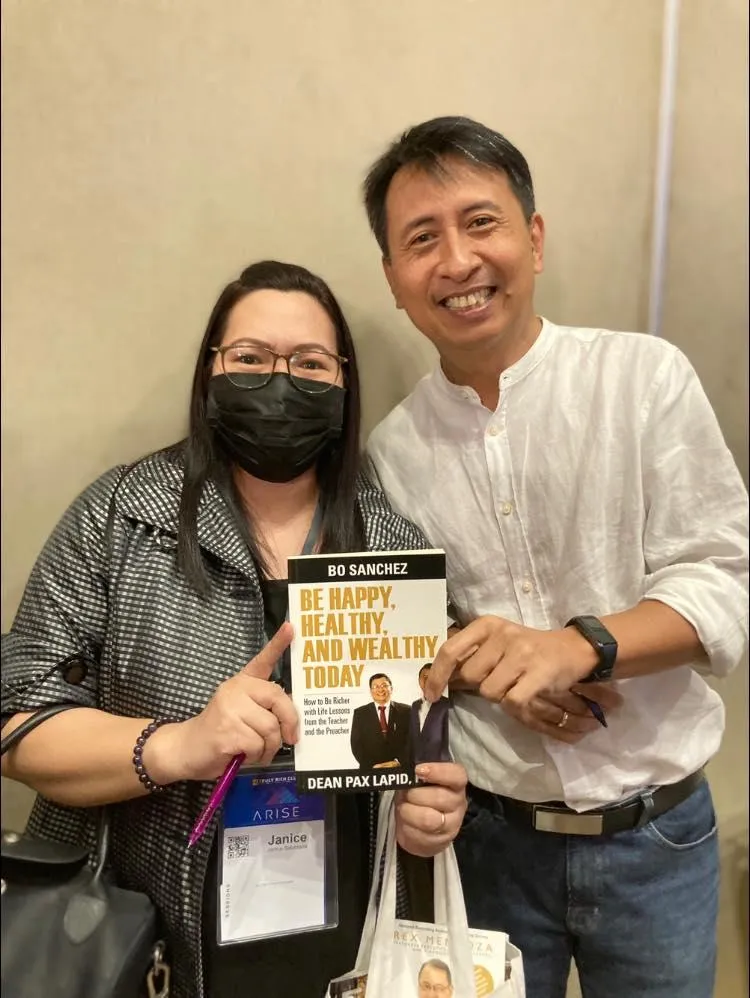

Janice Sabitsana is a Registered Financial Planner, Financial Speaker, Columnist and Content Creator.

Janice Sabitsana isn't your typical financial speaker. Growing up in a humble family where making ends meet was a daily struggle, Janice understands firsthand the stress and uncertainty that comes with financial hardship. But rather than letting these challenges define her, Janice was inspired to make a difference.

Determined to break the cycle of financial struggle, she embarked on a mission to make financial literacy accessible to all, regardless of background. Because Janice knows that everyone deserves the chance to thrive, to build a better future for themselves and their loved ones.

FROM STUDENT TO SPEAKER

With a background in psychology and a Master's from UP Diliman, Janice Sabitsana began her career as a licensed professional teacher, educating university students. Transitioning to corporate training, she honed her communication skills for seven years before delving into the financial industry.

Driven by a thirst for knowledge, Janice actively sought knowledge from various seminars and learned from a diverse array of financial experts and mentors. These experiences, coupled with her personal journey, have equipped her with a unique perspective and a deep understanding of the financial landscape.

With Chinkee Tan of Chink Positive

With Randell Tiongson of RFP Institute

With Bro. Bo Sanchez of Truly Rich Club

With Edward Lee of COL Financial

grab the budget bundle now!

Don't let money hold you back from what you deserve. These budget templates are your secret weapon. Get them today and take charge of your financial future. It's time to stop feeling broke and start feeling like the financial superstar you are!